Collectible & Investment Grade Art Works

Collectible and investment-grade artworks are among the most prestigious and resilient tangible assets available to sophisticated investors. Pieces by globally recognised artists such as Picasso, Warhol, Hockney, and Basquiat are valued not only for their cultural and aesthetic significance but also for their proven ability to appreciate in value across market cycles. Scarcity, institutional demand, and historical performance have firmly established this asset class as a key component in many high-net-worth portfolios.

At Bramwell Financial Group, we guide clients in acquiring blue-chip and emerging-market artworks with strong provenance, established exhibition history, and measurable market momentum. By focusing on works that combine artistic importance with financial viability, we offer access to a unique asset class that delivers both prestige and long-term capital growth.

Collectible & Investment Grade Art Works

Collectible and investment-grade artworks are among the most prestigious and resilient tangible assets available to sophisticated investors. Pieces by globally recognised artists—such as Picasso, Warhol, Hockney, and Basquiat—are valued not only for their cultural and aesthetic significance but also for their proven ability to appreciate in value across market cycles. Scarcity, institutional demand, and historical performance have firmly established this asset class as a key component in many high-net-worth portfolios.

At Bramwell Financial Group, we guide clients in acquiring blue-chip and emerging-market artworks with strong provenance, established exhibition history, and measurable market momentum. By focusing on works that combine artistic importance with financial viability, we offer access to a unique asset class that delivers both prestige and long-term capital growth.

Type of Investment

Investing in Contemporary Blue Chip Art involves acquiring physical artworks by artists with significant global demand and auction histories. These are pieces typically considered 'investment grade' due to their strong market performance, limited supply, and consistent appreciation over time.

Minimum Hold Period

Fine art is typically a medium to long-term investment, with a recommended minimum hold period of 5–7 years to realise optimal value growth. However, certain pieces can achieve strong returns in shorter periods depending on market conditions and artist popularity.

Minimum Investment Amount

Entry-level investments in blue chip art typically start from £5,000 to £22,500, depending on the artist and artwork provenance.

(Top-tier artworks from the most established artists may command much higher entry points.)

Market Overview

“Contemporary blue chip art has delivered an average annual return of 8–10% over the past 25 years, consistently outperforming global equities and demonstrating resilience through economic uncertainty.”

Asset Class Numbers

+140%

Contemporary art values have increased by over 140% over the last decade.

8%

The Artprice 100 Index (tracking top contemporary artists) has delivered an average annual return of 8% over 25 years.

$17.7b

In 2022, art auctions globally achieved a record $17.7 billion in sales, demonstrating strong market liquidity and demand

136%

Blue-chip art prices have outperformed the S&P 500 by 136% over the last 25 years.

(Source: Masterworks, Citi Global Art Market Report)

.jpg)

Historical Appreciation

Investment performance in the art market is influenced by artist recognition, exhibition history, scarcity, and macroeconomic conditions. The following breakdown outlines suggested holding periods for key collectible artworks, with estimated value increases based on historical appreciation and auction trends

Short Term (1-2 years)

Projected appreciation: +13% to +24.5%

-

George Condo – “Antipodal Reunion” (2018)

Condo’s auction prices have risen over 200% since 2017. Select works from this period could appreciate 30–50% over the next 5–10 years, driven by continued institutional demand and international visibility.

-

Keith Haring – “Untitled” (1983)

Prices for Haring’s early 1980s works have appreciated ~10% annually since 2015. Key pieces may grow by 25–40%, especially with museum-backed retrospectives and rising social relevance.

Medium Term (2–5 years)

Projected appreciation: +27% to +59%

-

Jean-Michel Basquiat – “Boy and Dog in a Johnnypump” (1982)

Basquiat’s market has grown over 500% in the past two decades. Mid-tier works from this era could see +60–100% gains over a 10–15 year window as scarcity intensifies.

-

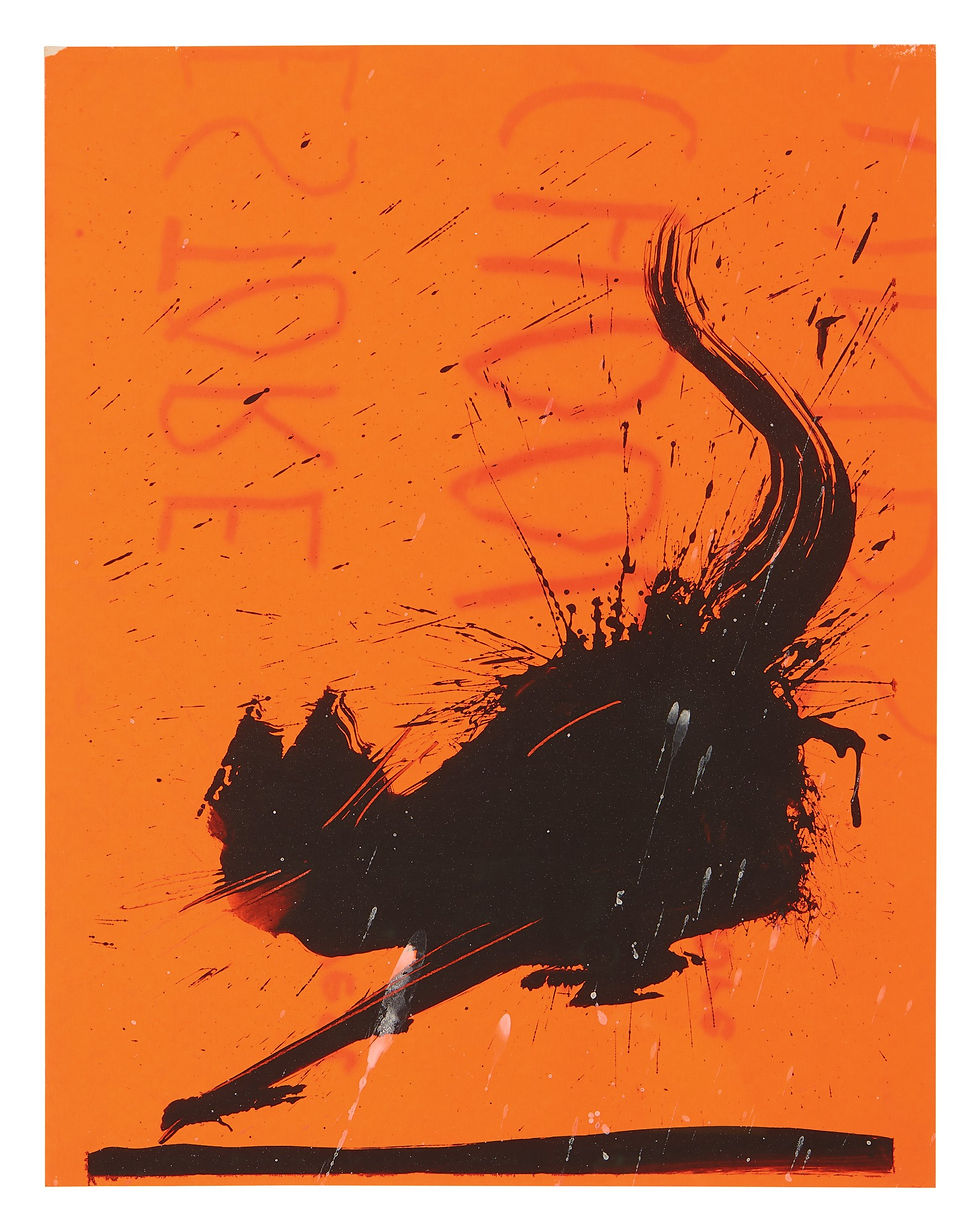

Richard Hambleton – “Shadowman” Series

Recent posthumous growth and documentary exposure have revived interest. With gallery support and growing institutional collection, these works may appreciate by 50–80%.

Long Term (5–10 years)

Projected appreciation: +60% to +112%

-

Salvador Dalí – “The Burning Giraffe” (1937)

Dalí’s blue-chip status and timeless cultural relevance support long-term performance. Museum-quality surrealist works could double or triple in value as major pieces become increasingly scarce.

-

Alan Davie – “Celtic Spirit” Series

Davie’s market is still undervalued despite strong critical support. Over 20–30 years, his unique visual style and collector cult following may drive +150–300% appreciation, particularly if institutional acquisitions increase.

Frequently Asked Questions

We understand that investing in tangible assets may naturally bring a lot of questions before you feel ready to make a decision. That’s why we’ve prepared a detailed FAQ section to provide clarity and confidence at every step. Of course, nothing replaces a personal conversation our team is always available for a no-obligation call or face-to-face meeting to guide you through your options and help align your investment with your long-term financial goals.

We partner with industry experts to select works by artists with established secondary markets, strong reputations, or museum representation. Every piece is carefully vetted for authenticity, provenance, and investment potential.

Clients can choose secure storage in climate-controlled facilities or take delivery. All works are fully insured while in storage.

Valuations are influenced by artist reputation, rarity, condition, and market trends. Art tends to perform well over longer holding periods and is often used as a hedge against financial volatility.

All pieces of Art purchased from Bramwell Financial will come with a 100% buyback agreement in place which allows all customers to ensure they can sell there individual pieces or portfolios within a timely manner

Investment grade fine art is not a regulated market due to fact that it sits within the tangible investment space which means you own and control exactly where your funds are at all times giving you the option buy more or sell off as frequently as you wish.

Ready to get started?

We’re here to guide you through every step of the process. Whether you’re new to Tangible investments or looking to expand an existing portfolio, our team will work with you to find the right fit for your goals, preferences, and risk appetite. Schedule a call or send us a message no pressure, just expert support, clarity, and a conversation grounded in your priorities.